There has been a drastic evolution in the process since our inaugural monthly budget meeting (thank goodness). January 13th, 2017. A day that will go down in infamy.

Here’s a little bit of a backstory. If you haven’t read Our Story, please do, but I’ll give you the quick an dirty of it. A few days earlier my hubby had come home and basically out of the blue said, We’re going to pay off 120 THOUSAND dollars in debt in the next 24 months. I was pregnant, we were living in a rental house waiting for our BRAND NEW dream home to be built, and I’m not sure he picked the greatest way to approach the subject. We could afford our bills, still went on vacation. What was the problem?! I kind of pretended that statement didn’t happen for a few days, then I realized, deeeeep way deep down that he was right. I didn’t want to be working overtime all the time and missing out on our little girl growing up, so we agreed to have our first of many budget meetings.

The Showdown

The first time we sat down face to face to talk about the budget was a bit of a showdown. My husband was the one who presented the idea, but I had done the legwork. I spent days gathering all the data of our spending over the prior 6 months. I looked at credit cards, bank statements, the cash we pulled out, EVERYTHING. Sifted through all of it to divide it in to categories. I did some work…

His initial response? How the hell did we spend $1500 dollars each month in groceries? How the hell did we spend $600 eating out. That’s it. We have to give up food altogether!

For sure we have to cut out Starbucks he says. Ha! Ha! My Starbucks?! He’s funny. I’m pregnant, I need my fraps! And then after the baby is born where will my caffeine come from?! I then argued that I wouldn’t be giving up my Starbucks unless he would be giving up his protein shakes. I mean who needs 2 protein shakes a day?

This went back and forth for a bit. Luckily for us most of our spending was MUTUAL spending. Neither one of us had gone on any recent shopping sprees lately. This may have been the only thing that kept us from killing each other. In fact, we noticed that we really didn’t have a of consumer spending EXCEPT the massive amount of eating out and food purchases. The rest was just random stuff. It was that random stuff, the $30 purchases at CVS, the $15 at Ulta, the $25 to Xbox Live, it was those purchases that added up.

The Progression

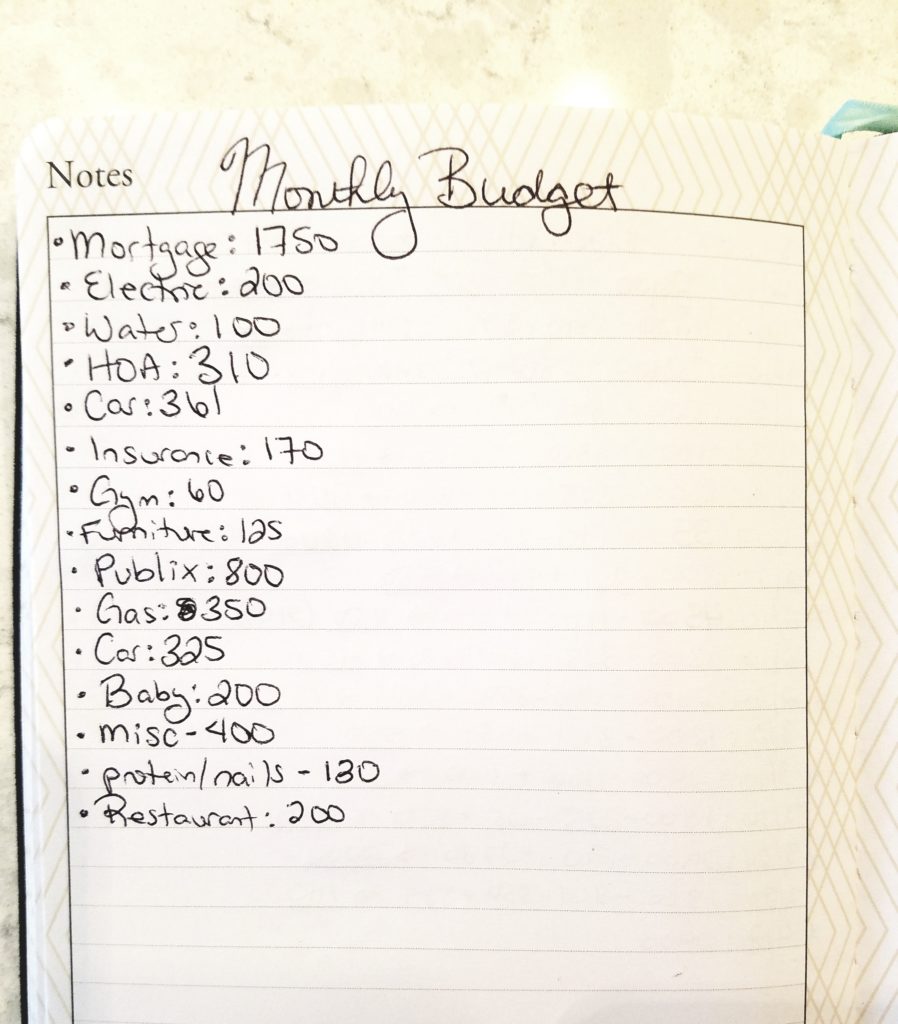

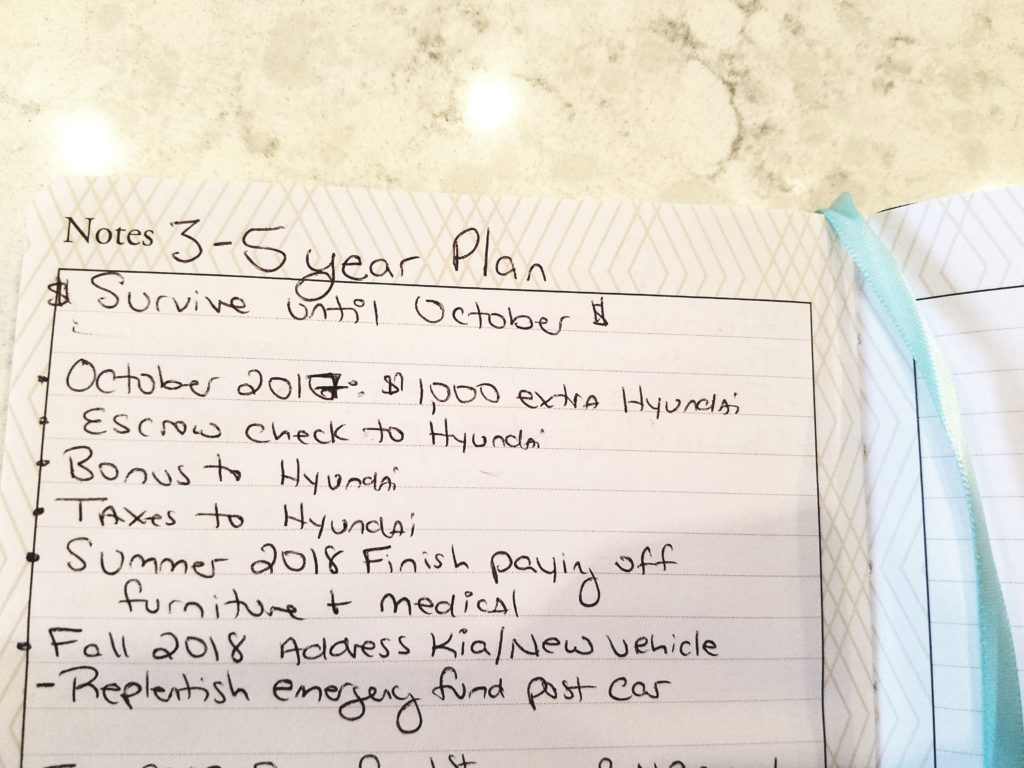

Finally, after a couple of knock down dragouts over how much we spent and where we were going to cut, we were able to pen our first budget. And, yes, I mean literally pen. We didn’t have an app yet, we didn’t know what the heck we were doing. We just broke up the categories and made our best guesses at what we would be spending. Rudimentary, but it worked for us.

This was our very first month budget  It is funny to look at. It really shows how far we’ve come. We discussed every single expense in detail and questioned if and how we could reduce that cost. We were nowhere near running at maximum efficiency but at least we were doing something we were finally being intentional with our money… We actually knew where our money was going.

It is funny to look at. It really shows how far we’ve come. We discussed every single expense in detail and questioned if and how we could reduce that cost. We were nowhere near running at maximum efficiency but at least we were doing something we were finally being intentional with our money… We actually knew where our money was going.

Having a plan is the single most important part of budgeting. You can do anything with your money but you have to choose what you’re going to do with it.

That first meeting took a couple of hours and was an emotional roller coaster to say the least. A big key was that we put it all on the table. We looked at EVERY expense and went over it together. We were face to face with the problem and we were going to fix it together.

After a couple of months we decided to step our game up and download an app (I mean come one we are millennials) EVERYDOLLAR LINK.. With this we were able to update our income and expenses in real time as soon as they happened, and we could be aware of any discrepancies immediately.

Where We Are Today

We’ve come a long way from the beginning. What I once struggled with, I now find excitement in. I try to find ways to make cuts in the budget without having a negative impact in our lives. My post on How I Saved Thousands on Baby Diapers proves that! It’s all about having a plan and living intentionally.

These days we still do a budget meeting EVERY MONTH but it is basically a seamless, hassle free process that takes us about 10 minutes. We know what we spend in each category most months. So there usually aren’t any changes there. Then, we just discuss if there are any income anomalies this month or any one time/unexpected purchases coming up, and we plug it in. That’s it!

There are really no disagreements at this point as we are in sync with our finances. I wouldn’t say we really argued before, but there were definitely a lot of not so fun conversations regarding money. To those who have not yet achieved freedom from debt this may sound crazy, and it feels a bit crazy. There is just no need to argue about money when you both fully understand why you are doing this and what your goals for our family are.

So, January 13th 2017. You may continue to live in infamy because you are a reminder of where we have been and how far we have come. “Stop comparing yourselves to others and start comparing yourself to your yesterday!”

If you would like to hear more about our story, want some extra tips or recipes, Sign up below for your FREE updates!