Starting out in our relationship 7 years ago we thought were doing well. We bought a large home together, both had the jobs we had worked hard for and loved, and had our wedding coming up. We seemed to be way ahead of our peers in the check off boxes of life and we were happy where life was taking us. We had a little bit of debt but easily paying things off. However, we also had very very little savings and didn’t have a plan. But we were young, plenty of time to save later!

Fast forward 3 years we hit a speed bump. We had been having trouble conceiving and things went from a little stressful to a full on life change when we found out we would not be able to conceive without the help of in vitro fertilization (IVF). The process took us a little under 3 years and somewhere north of $90,000 to achieve success. All the while we worked overtime in order to be able to keep a small piece of normalcy in our lives, traveling.

It’s strange because we didn’t stop to think how much stress making a budget could relieve. We just kept spending each month and doing our best to pay off the medical bills but never got there. We just kept getting behind. Credit cards and 0% payment plans were our friends. We even sold my hubby’s truck to get some cash for yet another procedure, but we never thought to budget?…

Fast forward yet again to January 2017. We were living in a rental home waiting for our new “downsized” home to be built – smaller but the monthly payment would be the same so of course we thought we could afford it. I was around 6 months pregnant, still working as a nurse and my hubby a firefighter. We had a $26,000 car loan, a leased car we were draining $350 per month in to, medical bills for both my hubby and of course for our million dollar miracle baby, and even a $7,500 loan on the furniture we were sitting on, plus some various other debt. All in all totaling upwards of $120k. We were broke.

Even though we owed over ONE HUNDRED AND TWENTY THOUSAND DOLLARS, we really weren’t overly concerned about our debt because everyone has debt, and I set everything up on a payment plan that we could “afford”.

Oh how we were wrong.

The Day Everything Changed

· January 13th 2017. The day that will live in infamy.

My hubby came home and said “We are going to pay off 120k in debt in 24 months”. Naturally my only response was an open mouth and a question mark on my forehead. I still remember my initial thought of Why do we need to do this? That thought was followed by a flood of other thoughts.

You see I had been managing our money for the previous 5 years. Hubby didn’t even know the access passwords to most of our accounts. We trusted each other and never had money “problems”, but truth be told I was overwhelmed. I hid a lot of stress from him as I did the math over and over making sure we would make it until the next paycheck would come. I would put things on credit cards and say I would pay them with the next check and sometimes other things would come up – like another procedure or a flat tire that needed repair – and that credit card wouldn’t get paid that month.

I would work overtime if I knew we wanted to do something, go somewhere or if we had holidays coming up. I would be so thankful if one of our checks had some extra money on it because I could pay for that credit card bill or put it towards the cruise we already planned. I felt like I was doing my best for our family, but looking back it could have been so much easier if I had just asked for help.

Unbeknownst to me my hubby had been spending countless hours researching, listening to podcasts, reading forums, and talking to others who had gotten themselves out of debt. He saw we had a problem and, being the husband he is, came up with a solution before bringing it to me.

So on January 13th 2017, we set out to change our lives, our daughter’s life. We no longer wanted to be the “norm”, no longer wanted to live paycheck to paycheck, and no longer wanted to be in debt.

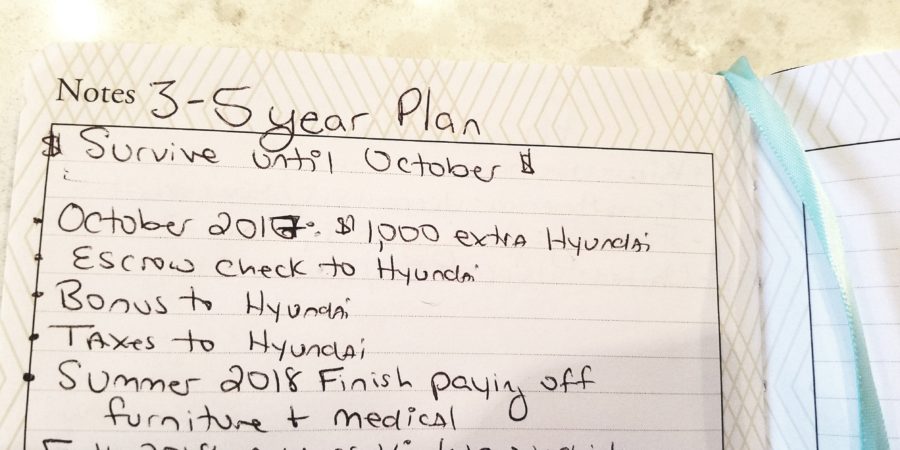

The Plan

“Thought we were making good choices with our money. We were wrong.”

We sat down and looked, really looked, at the past 3-6 months of expenses, laid them all out and sat back in a combination of awe and disgust. $1500 on groceries?! $300 at STARBUCKS? What were we doing?!

We thought that because I didn’t go on shopping sprees and hubby didn’t go golfing every weekend or out with the guys, that we were making wise choices with our money. We were wrong, and the craziest part is that we had NO IDEA how wrong we were.

We made a list of our income, using the lowest possible as our number, and we looked at our expenses – hurt us every time we looked. Then, we dug deep and sifted through ALL of our debt. No skeletons left in the closet, no secrets, no hidden ANYTHING. Not a pretty site, but there it was.

Decreasing Our Spending

Looking at our expenses we came up with a reasonable number for each budget category and laid those out. I was so surprised at the sheer amount of “unnoticed” money we were spending. By unnoticed I meaning we had nothing to show for it. We had to make some changes.

Some categories were unavoidable, like gas, but others we were able to control more and that’s what we focused on.

Groceries is where I knew I could make some changes. The problem was that I also knew that value of eating healthy and we really loved to try out gourmet recipes at home. It took some trial and error but I figured that out. I have a grocery post coming out that will outline exactly what we did.

Each month we would get better and better. I look back on our initial, archaically written – yes written – budget and I gave us $800 PER MONTH for groceries, for 2 of us! If you look now it is still on the high side of $550, but where we are comfortable. Most months we spend less, but some months we spend it all. I even managed to fit my daughter’s 1st birthday in to that food budget and we cooked for over 70 people! Anything is doable. Just have to have a plan.

We by no means cut out everything from our lives. We still went out to eat, I still got the occasional Starbucks, and we most definitely traveled. The difference was that every move we made, every dollar we spent was thought out. Did I really NEED that coffee? Did we really NEED those throw pillows? It was a matter of living intentionally and by living intentionally we were able to budget without the stigma that is normally associated with budgeting, which is deprivation. We did not deprive ourselves, we simply chose to spend our money on things that we NEEDED, things that brought value to our lives.

Increasing Our Income

Here’s the kind of fun part. We did work a bit of overtime, especially to pay off the bills for the fertility treatments, but we also very much valued the time we spent together. So… we had to come up with some creative ways to boost that income because there was no way in H E double hockey sticks that we would be able to pay off 120K as fast as we wanted to without something more than our standard income.

First and foremost we downsized our home. Used the cash for a down payment on the next house – goodbye PMI and high interest loan, and whatever was left got thrown at the medical bills.

Then there was the side hustle. Oh the side hustle. Basically the side hustle is ANYTHING you do on the side of your regular job. We did quite a few things actually. We hadn’t been introduced to the online businesses, blogging, or any of the other “cool” ways I would love to try today, but there were still ways to make a few extra dollars.

One of the things I loved to do was redo furniture. I would either take a piece we owned and spruce it up or find things in thrift stores, garage sales, or the trash. You slap a little paint on them, distress them a bit, and BAM you’ve got a “farmhouse table” or a “vintage look dresser”.

Next we sold some things. A lot of things. We had already sold my hubby’s truck to pay for a procedure we needed cash NOW for, so I focused on the smaller items. There are some great places to sell basically anything, from Facebook to Ebay to OfferUp to Amazon. I sold everything. Look around your house. Anything you’re not using? Really want to pay off that debt? Sell it!

Sounds a little crazy, but I can guarantee you I don’t miss any of the things I sold. They were simply taking up space. Looking back I think we bought so much because we had such a big house we felt the need to fill it.

There were other various things we would do to make a little extra cash including working as a babysitter in our late 20’s, dog walkers, cleaning random friends’ and family members’ houses. You name it, we did it.

The End Result

We beat our original goal of paying off 120k in 24 months by paying that ONE HUNDRED AND TWENTY THOUSAND DOLLARS in less than 12 months!!! We paid it off before my daughter was even born.

I didn’t realize how much satisfaction I would get from this process until I paid off that $26,000 car loan in one phone call. It was the most liberating feeling knowing I owned that car!

I’m pretty sure that was my official turning point. All I wanted to do was find ways to maximize our money, to make our money work for us.

Every month I cut a little bit more from our budget until I hit the point where we could feel the impact – it was a waaaaay lower number in most categories than I would have ever guessed. I would find ways to save without losing the quality of what we were buying – groceries was the biggest saver – and I would take pride when we were under budget in a category that month.

Of course we had months where we didn’t do so well. I looked back at our budget and we went over nearly every month in the first 6 months. It’s a learning processes! The key is persistence. Every month we would sit down and redo the budget and every month we would learn something new. We kept each other motivated and made every effort not to criticize if one of us made an err in judgement – I swear they put crack in those Starbucks drinks.

Fast forward to our original 24 month deadline. We have taken ourselves out of debt, out of $120,000 in debt, and a negative net worth that we didn’t even bother to calculate, and now have a net worth in the six figures with no plans of slowing down.

We don’t lead a life of deprivation. We lead of life of intention and planning and therefore can focus more time on the things we love and the things that bring joy to our lives. We spend more time with our daughter and each other, go on even more amazing vacations, eat the most delicious foods and have unforgettable experiences. We are finally truly Living Life and Loving Us!!!

If you’re interested in hearing more and getting tips on how you can change your life too, sign up below for your FREE updates!

Wow. What an incredible story. You and your husband have a very strong bond. You’ve overcame so much together! Congratulations on being debt free, and we look forward to hearing more about your journey!

We are very very lucky to have found each other. He really is my rock and is the reason we started this whole journey.

I love that you left a comment. Hubby and I actually follow y’all too. This whole community of people that we’ve fallen in to has been amazing!

Oh my goodness!! Amazing!!!! First, bless your heart for everything you went through for your miracle baby ❤️❤️ You are such an inspiration. My husband and I are in debt as well. Not nearly that much, but we have an unnecessary truck payment, credit card bill and line of credit we need to get rid of. We have worked so hard and I’m proud of our success, however, reading your post, I now see that we can definitely do more! Thank you!

You’re already doing so well. When we started getting in to it I was just so amazed at how much debt the average person really had. The craziest part is that it’s pretty much accepted as normal to always have debt.

Keep at it!

I need that next blog post about your grocery budget – it. is. a. problem. We, like you, are also super conscious about the food we buy and have a hard time reconciling budget with getting humane eggs and quality meat and fresh or frozen veggies. We also definitely spend too much eating out for dinner and lunch, but the time budget is an issue as well.

Enjoying your blog Jenny ?

I am trying to get that one out before we leave next week. Groceries has for sure been our biggest saver!

I think the key is knowing what uour family uses consistently and building from there. We went from throwing out half our purchases to now it’s next to nothing. Just build a base then get creative with recipes with that base. It keeps you from impulse shopping!

Have you read my post on “Think you don’t have time to food prep? Think again?” Lol funny name but it’s true. That’s something I still struggle with and have to remind myself to do constantly, but it’s also a huge lifesaver.

I’ll get that grocery post out soon!! Keep making small changes though. You’ll really see it over time.

This was a great post! My hubby and I have always had “money issues”, he’s a saver I’m a spender. There are some good tips in here!

I appreciate you really reading it! I was the spender as well. Nothing crazy but I will be the first to admit I had a pretty materialistic view on life.

It’s crazy what a few changes can make to your life and even relationship!

This is awesome. I know I need to sit down and do a budget. I have been putting it off for a long time. Maybe it is finally time.

If you ever need help let me know! I have a few posts on how to get started but always ask if you ever have questions.

I was so afraid the budget would control or limit me but it really just made me conscious of my spending and assured me I would never spend more than we made that month!

Extremely inspirational story. It seems for my 23 adulting years I can never get ahead…you give me hope and solutions!!

Adulting is highly over rated first of all 😉 but if you have to do it then being smart with your money makes all of the difference. I can’t believe how much our lives have changed in the past few years. Not stressing over money is just mind blowing. For example, I was canceled at the hospital and have been off for 2 weeks. Although I wish I was making the money, it’s ok. We don’t depend on that paycheck for living expenses so I’ve just been enjoying my time off.

I’m excited for you to start!

Very nice post. I intend to assume that I have a debt to pay force myself to save. This post exactly gives me the directions to do that. Thanks.

The biggest part of accomplishing paying off debt is being able to see your goal and really want it. Anything is possible, but getting your mind in the right place first is the most important step.

Your story is remarkable. This post contains a lot of great information on intentionally managing your finances while still living a non-deprived life.

That was the whole goal. You’ll never stick to something if you deprive yourself completely.

This is amazing!! Congrats!!

It’s so eye opening to see how much extra stuff we spend money on and it doesn’t mean we have to cut things out. Like you say just plan and be smarter about it.

“Side hustle” is a great phrase and I think it’s great how you sell extra bits and can make furniture cool.

Thanks so much for sharing I got a lot out of this

Mike

Congratulations on your accomplishments! I am so excited about the freedom that you and your family has earned during this life-changing experience. My husband and I just went through a similar process I know we look at money through a totally different lens!

Heather

I’m so glad you got distracted on our site and found this. I would love to read your story. Could you either email me the link or message me in the Facebook group?

The whole goal of the blog was to reach people who have had similar experiences or help others understand.

Where there any specific incidents where you feel you went overboard and didn’t realize it until later? You said you didn’t deprive yourselves, but my wife and I found a few times where we were too aggressive and didn’t realize it until a bit later.

It’s difficult to decide when you crossed the point between fiscal responsibility and deprivation – especially energized by large goals.

Great post! We will bbe linking to this great post on our website.

Keep up the grreat writing.